YouGov

The comprehensive whitepaper published by Equifax identifies that the issue of debt and mental health in the workplace needs to be addressed. Yet figures from a Deloitte[3] report show that around 72% of workplaces have no mental health policy in place. This suggests that the majority of employers are failing to monitor or assess the mental health of their workforce. As the connection between debt and mental health becomes more evident, businesses have a duty of care to support their employees’ financial well-being.

Mark Bratley, Business Development Director at Equifax, comments, “Wellbeing at work often focuses on physical illness, with less thought spent on the less visible issue of mental health. The fact that there is still a stigma attached to mental health issues[4] can leave people feeling isolated and unable to talk to anyone about their condition. This costs employers in lost talent and productivity, making financial wellbeing support a vital part of an organisation’s overall wellness activity.”

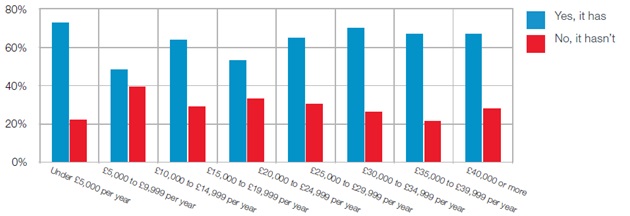

Absence due to mental health has risen by 5% since 2009[5] despite an overall fall in sickness absence of 15%-20% over the same period. According to the Equifax-commissioned YouGov research, sleeplessness affects the mental health of 64% of workers in Britain, with those earning between £5,000 and £9,999 per year most affected (73%), followed by 70% of those in the £30,000 to £34,999 wage bracket.

Workers who believe that struggling to get a good night’s sleep impacts their mental health – analysed by income

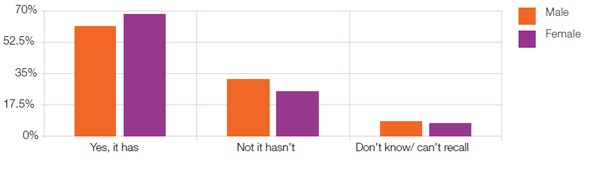

Over half of all people surveyed believe that struggling to get a good night’s sleep has an impact on their mental health. And it is the youngest age group – 18-24-year-olds – that appears to be the hardest hit mentally by struggling to get a good night’s sleep. Women appear to suffer more than men.

Workers who believe that struggling to get a good night’s sleep impacts their mental health – analysed by gender

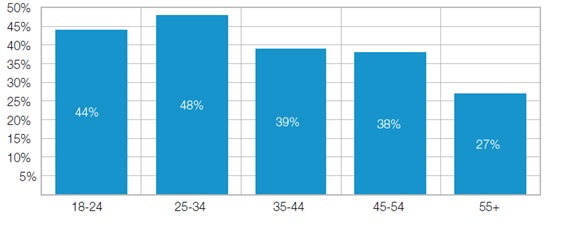

The research also revealed over a third (38%) of people who work said that money worries have stopped them from getting a good night’s sleep. It appears that women are more likely to stay awake worrying about money (44%), compared to men (34%).

25 to 34 year-olds are most likely to have sleepless nights because of financial concerns (48%), followed by 18 to 24 year-olds (44%). In contrast, only 27% of over 55s are kept awake at night worrying about money.

Workers who said that money worries have stopped them from getting a good night’s sleep – analysed by age

Bratley concludes, “Our research shows the connection between mental health and debt, highlighting the need for employers to focus on this aspect of staff wellbeing. Given that the total cost of poor mental health to the economy is between £74 billion and £99 billion per year[6], it is clear employers have a role to play in creating a positive workplace that offers a safe space for staff by having good processes in place.”